Finances in ITNRides- An Overview

General Overview

One of the functions that ITNRides can be used for is financial management. The system can be used to bill for rides, manage customer accounts, calculate volunteer reimbursement or credits, process payments, track donations, and implement ITN Programs that allow third parties and community partners to help cover the cost of rides. Communities can use parts of the financial system even if they don’t charge or rides, by tracking donations and grants in the system.

To make all of these things possible, all riders and drivers have a Personal Transportation Account associated with them in the system.

Personal Transportation Accounts

A Personal Transportation Account, or PTA, is like a transportation portfolio that tracks assets used to cover the cost of transportation. All riders and drivers will have a PTA, set up as an Account that is linked to their Contact Record. (This is automatically set up by the system when a new rider or driver is entered and will be created and used to track rides and mileage even if you don’t charge for rides). Ride Sponsors participating in programs like Ride Services, Healthy Miles, Ride & Shop, and Road Scholarships will also have PTAs. PTAs use built in transactions to bill for rides and membership fees (if applicable), apply credits, and distribute the cost of rides amongst sponsors when those programs are in use. A monthly statement is generated for each rider and sponsor, and accounts are also viewable on the rider and driver portals.

Credits in a PTA are either refundable (cash paid into the system via cash, check or credit card payments) or nonrefundable (volunteer credits, car trade credits, birthday or referral credits). Both can be used for any charges in the system, but nonrefundable credits cannot be cashed out when an account is closed. The system is set up to use nonrefundable credits first, if there are any in a PTA.

Customization Options

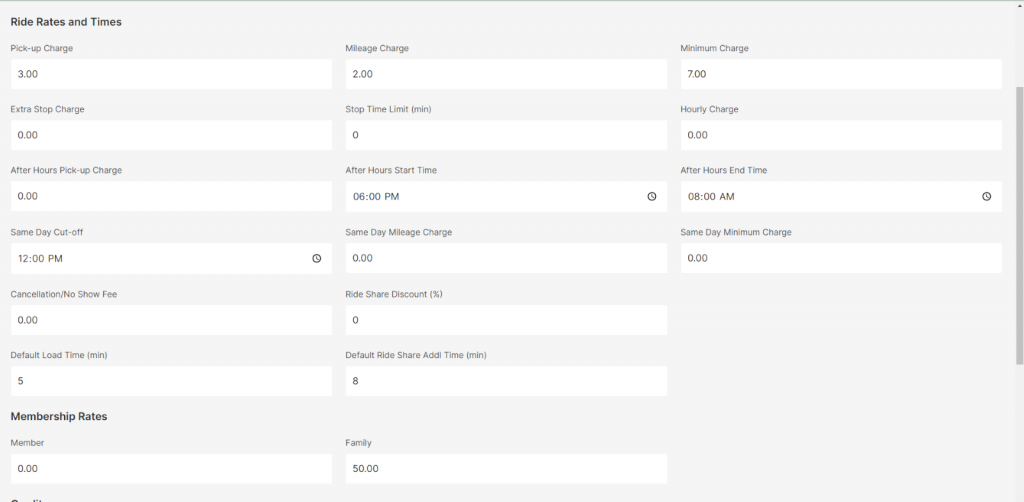

Sites can customize many aspects of the charges that they want to apply in ITNRides. They decide if they would like to charge for rides, for a yearly membership fee, and if they want to reimburse their volunteers and at what rate per mile. Ride charges can be a flat rate, a tiered rate, or based on mileage. Extra charges or different rates can be set for same-day rides, or rides after a certain time (late-night rides for example). The screenshot below shows some of the customization options available in ITNRides.

Opportunities and Other Terminology

Just like Personal Transportation Accounts, there are some aspects of the financial system that have specific terminology associated with them. Some of these are general finance terms, some are ITNAmerica terms, and some are Salesforce terms. See below for the terms and definitions that are used for finances in ITNRides. Several of these items will be explained in more detail later.

Opportunities: Opportunities refer to anything that has to do with money coming into the system. This is a Salesforce term. This includes payments from riders, donations, grants, and membership payments. Opportunities can have several stages:

- Pledged: Someone has stated they will be paying you a certain amount, but you don’t have the payment yet.

- Posted: The payment has been received and applied to the correct account. Work related to the payment may be ongoing.

- Closed: All work related to the payment is over.

- Lost: The payment did not come in as expected.

Chargent: The credit card processor built into the ITNRides system, used to process manual credit card payments.

GL Posting Report/General Ledger: Finance report created monthly that categorizes and groups all the financial transactions in ITNRides to be entered into an official financial tracking system like Quickbooks.

Monthly Statement: A monthly report/bill that shows a rider or ride sponsor’s charges and payments. One is generated for each rider and can be printed for mailing.

Posting Delay: The date in a month that the previous month closes, and rides and transactions will no longer be editable. After this date the Monthly Statements and the GL Posting Report for the previous month can be run.

TAIs: Transaction Account Items are ride charges, payments, and account adjustments.

TLIs: Transaction Line Items are other charges in the system like membership charges.

Volunteer Statement: This is a yearly statement created for volunteer drivers showing their occupied and unoccupied mileage for the previous calendar year.

TAIs and TLIs

TAIs (ride charges) are created when rides are booked, and the mileage for the ride is calculated. This allows the system to display the customer’s balance with rides booked out for the next 30 days. When changes are made to rides, the TAIs should automatically update, but if they do not you can go to the ride record and click recalculate TAIs to refresh the calculations. All other financial transactions all post overnight, so changes made in the system will not immediately be visible. The PTA will adjust overnight.

TLIs also show up on rider statements and include things like membership charges and account adjustments. Most of these result from automated processes, and don’t require staff to process the transactions. To see your TLIs for the month, check the TLIs with Opps by Site report.

Transactions can be added at any point during the month, up until two days prior to the posting delay in the next month. Due to financial transactions and accounts updating overnight, it is essential that all financial transactions be entered at least 2 days before your Month End Closing Date. So, if your month closes on the 6th, all financial transactions must be entered by the 4th.

The GL Posting Report

The GL Posting report is created at the end of each month, detailing all the financial transactions that took place throughout the month, and assigning them to categories for financial record keeping. The report incorporated the ITN Chart of Accounts, which all affiliates use, and which ITNCountry sites are welcome to use if they wish.

The report consists of 4 columns. A blank example is shown below. In a real report, amounts would show in the debit or credit columns for categories/accounts that had any applicable transactions during the month. If a site is using ITNs Chart of Accounts for its record keeping, this report makes monthly journal entries a simple act of tranferring these amounts to the official record keeping system (like Quickbooks). If a site is using a different chart of accounts, they can use the category descriptions to decide what account each should correspond to.

To see the details of what each categorized amount includes, see 2 reports in ITNRides- TAIs Posted by Timeframe and TLIs with Opps by Site. These two reports contain all the transactions that make up the GL Posting Report, and can be run after the month closes.

| Debit | Credit | Account | Account Description |

| 1070.00 | Clearing Acct. – Ops Receipts | ||

| 1510.00 | Vehicles | ||

| 1590.00 | Capital Purchases | ||

| 2012.00 | Customer Account Refundable | ||

| 2400.05 | Prepaid Fares – Refundable | ||

| 2400.10 | Prepaid Fares – Non-refundable | ||

| 2400.20 | Road Scholarship Fund | ||

| 4010.00 | Ride Revenue – Paid Driver Fares | ||

| 4020.00 | Ride Revenue – Volunteer Driver Fares | ||

| 4030.00 | Ride Revenue – Miscellaneous | ||

| 4050.00 | Ride Revenue – 3rd Party Driver Fares | ||

| 4100.00 | Merchant Participation Revenue | ||

| 4200.00 | Membership Dues | ||

| 4270.00 | Donated Services | ||

| 4280.00 | Car Donation Revenue | ||

| 4295.00 | Equipment Donations | ||

| 4320.00 | Corporate Sponsorship | ||

| 4330.00 | Fundraising Event Donations | ||

| 4333.00 | Volunteer Giveback | ||

| 4335.00 | Contributions – Customer Donation | ||

| 4360.00 | Donations | ||

| 4510.00 | Private Grants | ||

| 4610.00 | Public / Government Grants | ||

| 4820.00 | Miscellaneous Income | ||

| 4900.00 | Account Adjustments | ||

| 7170.00 | Customer Birthday Credits | ||

| 7175.00 | Customer Referral Credits | ||

| 7520.00 | Occupied Miles Volunteers | ||

| 7530.00 | Unoccupied Miles Volunteers | ||

| 7900.00 | In-Kind donation offset | ||

| $0.00 | $0.00 | TOTAL |